E-Invoicing

The regulations by the Saudi Govt requires businesses to generate invoices using software or any electronic system. ZATCA e-invoicing Phase 1 requires invoices with QR code to be generated while Phase 2 requires submission of invoices electronically to the government.

The United Arab Emirates (UAE) is moving towards a fully digitized tax system with the implementation of e-invoicing under the "E-Billing System." By July 2026, e-Invoicing UAE will become mandatory for B2B and Business-to-Government (B2G) transactions

ZATCA e-invoicing Phase 1

Our solution involves entry of invoices into Sage software. The invoice formats are customized to suit the requirements of ZATCA. QR code will be embedded in the invoices to send to customers.

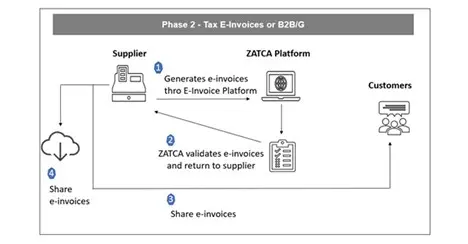

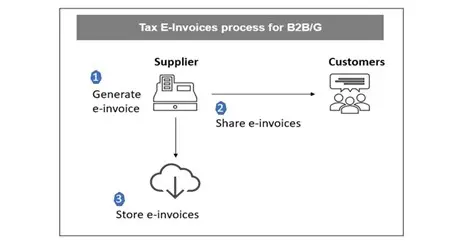

ZATCA e-invoicing Phase 2

· Software development integrates e-invoicing to ZATCA portal for direct submission.

· Invoice for each company is customized to be sent in XML format.

· Invoices in XML formats will be sent directly to the ZATCA portal.

· ZATCA validated invoice will be received.

· Validated invoices can be printed and sent to customers.